Miners are responding to a rosier metal outlook by increasing spending on exploration and releasing more assay results.

Base metal prices are up. Copper bounced off its 2015 nadir of $4,500 a tonne and in the last few months has found a range of $6,600 to $6,700 a tonne, a metal price that ING says is good level to sustain investment. Nickel is on a tear. It jumped to $15,340 a tonne today, its highest close since January 2015

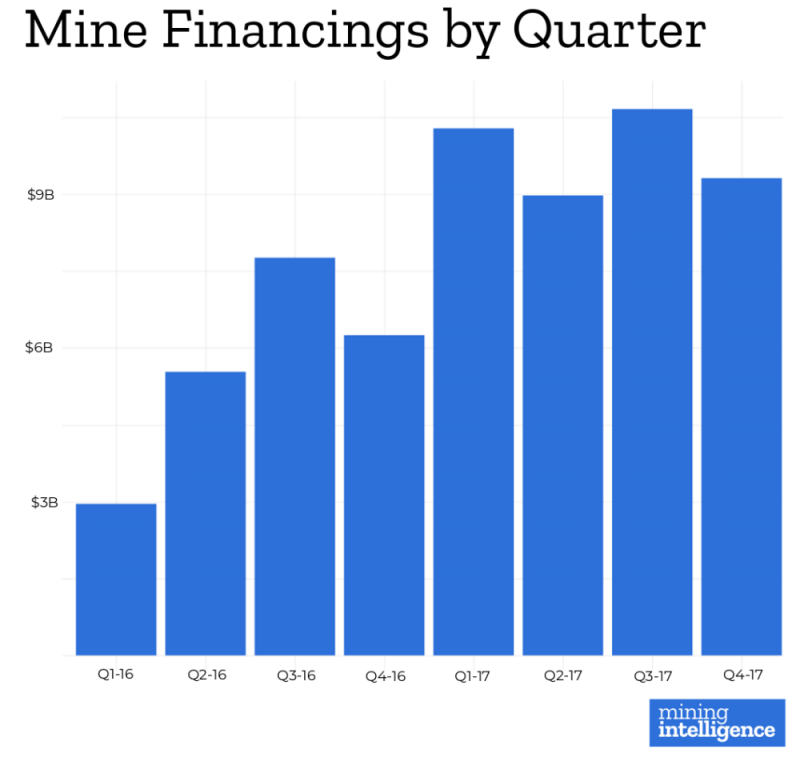

With better metal prices miners are asking for more money. In 2017 miners sought financing totalling $39B compared to $22B in 2016 according to data from Mining Intelligence. Amounts are compiled from publicly-traded companies worldwide that declared intentions to raise funds.

The size of the ask was larger, too. The average funding request was up 25% over the past two years.

Juniors and miners are exploring.

Global mining exploration is expected to increase 15% to 20% year-over-year.

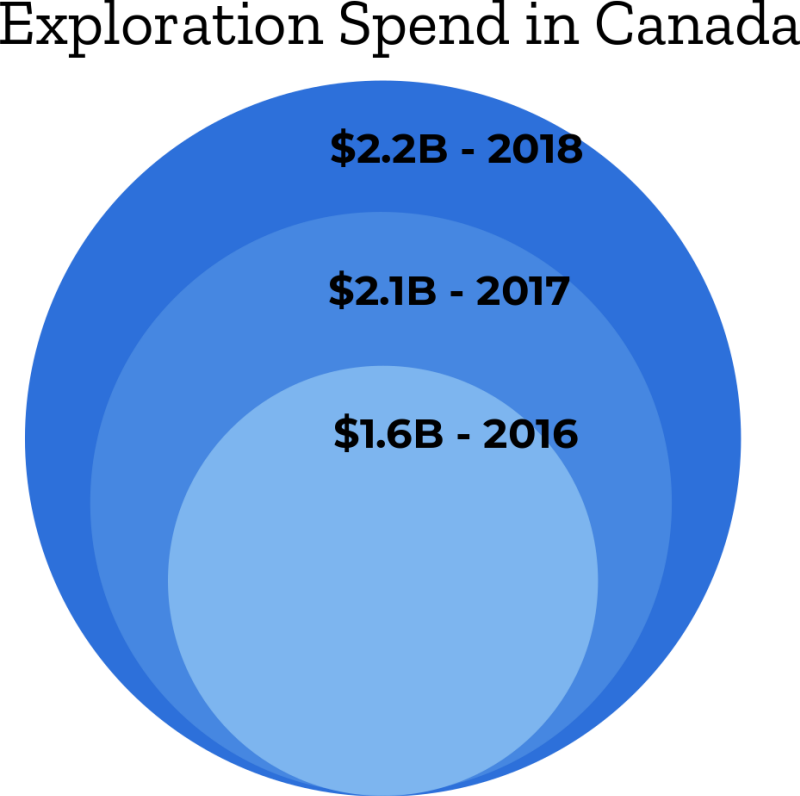

In Canada the exploration spend has grown 37% in the last two years, and total exploration spend in 2018 is forecast at $2.2B.

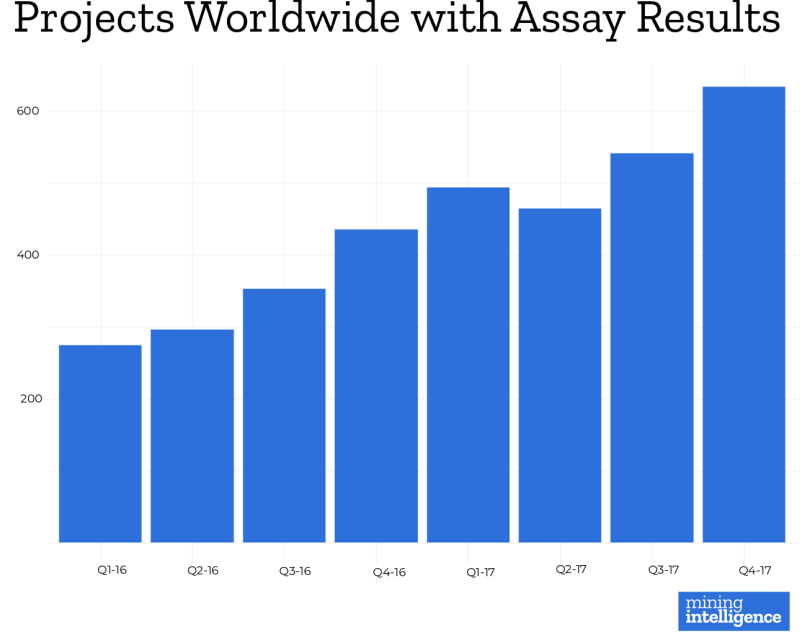

And consequently more core is heading to the lab.

The number of projects worldwide with assay results increased 57% in 2017 over the previous year.

Sign up for Mining Intelligence and get rich insights about miners, juniors and projects. Our online tool puts rich data at your fingertips.

Creative commons image of diver by Ollie Harridge.

The post Metal prices, financing, exploration and assays are all up appeared first on ...