(IDEX Online) - British miner BlueRock says COVID-19 knocked 15 per cent off the price of rough diamonds sold from its Kareevlei mine, in South Africa.

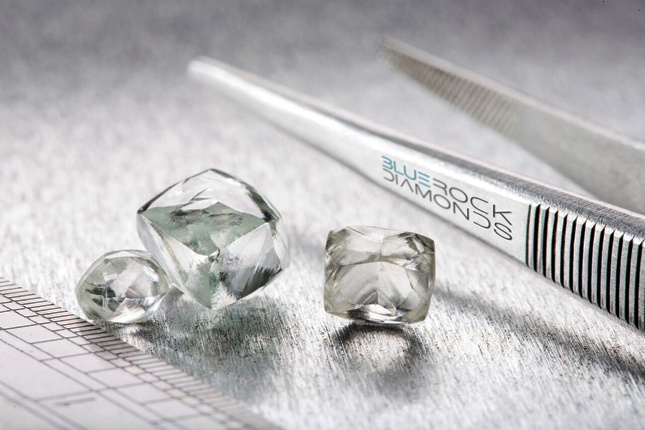

The company yesterday announced the private sale of 2,400 carats for a total of $700,000, averaging $290 a carat.

"The parcel sold did not contain any notable high value diamonds and therefore the price achieved is approximately 15% below what we would have expected to achieve for this parcel pre the Covid-19 pandemic," said executive chairman Mike Houston.

Bigger miners, such as Alrosa, De Beers and Rio Tinto, have been pursuing price-over-volume strategies rather than lowering prices.

BlueRock announced last month that it will brand its stones as Kareevlei Diamonds and sell them in Antwerp to attract more buyers.

Mr Houston said: "It remains our plan to sell our future production through Bonas-Couzyn N.V, in Antwerp as per our arrangement announced on 13 May 2020.

"We now anticipate that the first sale of Kareevlei diamonds in Antwerp will be in September with June to August production pre-financed monthly at 70% of value by Delgatto Diamond Finance Fund LP in accordance with our non-binding letter of intent."

BlueRock has reported record output, up almost two-thirds on Q4 of 2019, since it re-opened after the lifting of COVID-19 restrictions....